[最新] bond yield to maturity calculator 238338-Zero coupon bond yield to maturity calculator

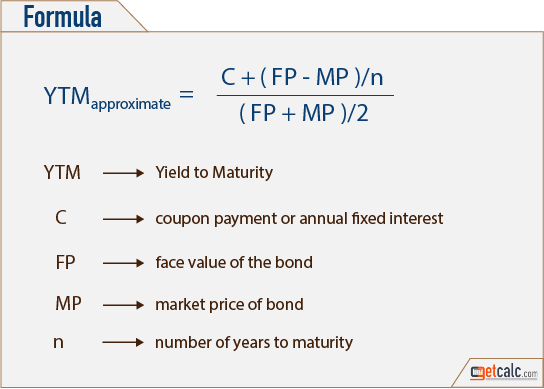

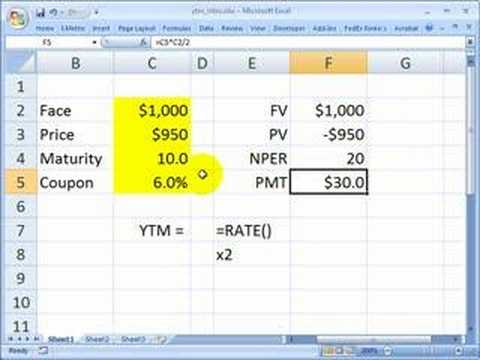

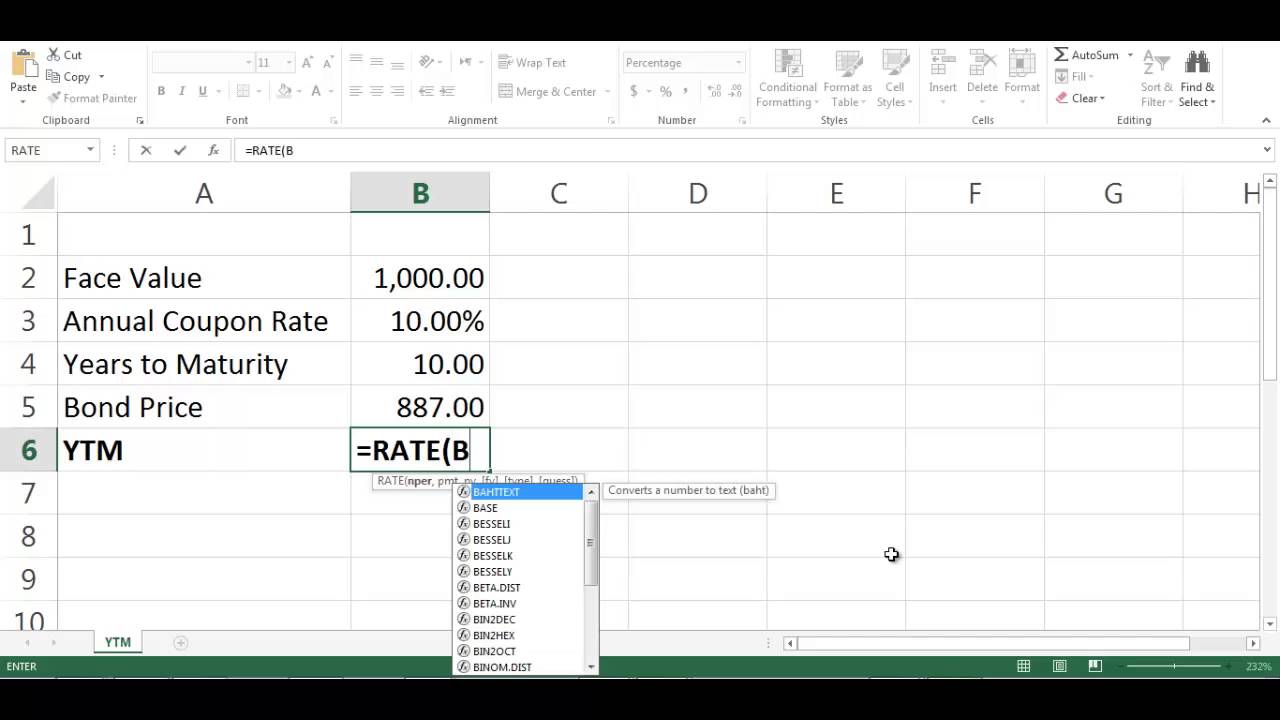

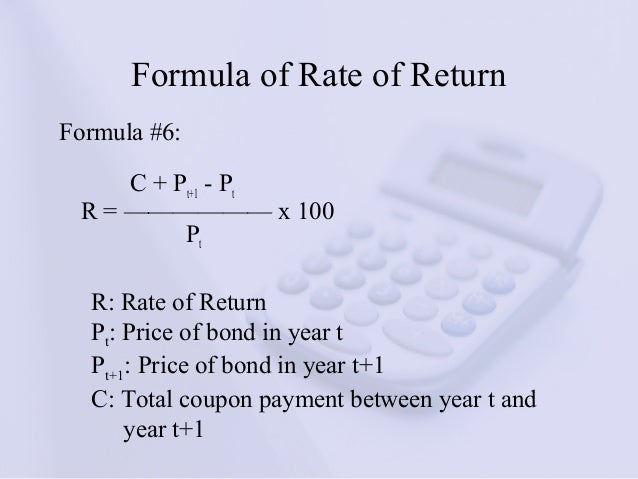

How to Calculate Yield to Maturity Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond's future coupon payments In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturityThis free online Bond Value Calculator will calculate the expected trading price of a bond given the par value, coupon rate, market rate, interest payments per year, and yearstomaturity Plus, the calculated results will show the stepbystep solution to the bond valuation formula, as well as a chart showing the present values of the parInstead, one can approximate YTM by using a bond yield table, financial calculator, or online yield to maturity calculator Although yield to maturity represents an annualized rate of return on a

What Is Yield To Maturity How To Calculate It Scripbox

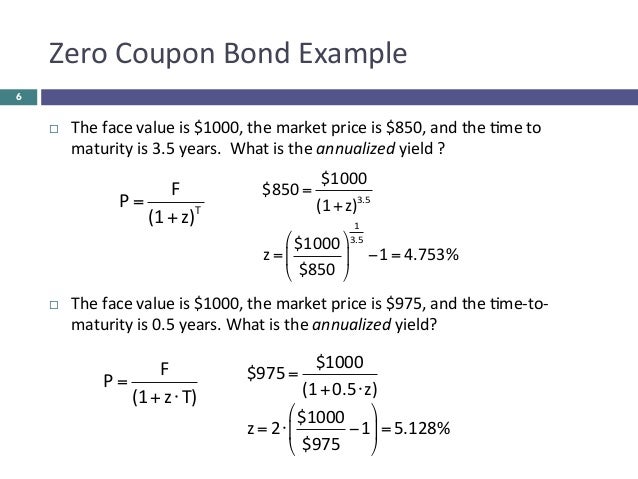

Zero coupon bond yield to maturity calculator

Zero coupon bond yield to maturity calculator-Online financial calculator to calculate yield to maturity based annual interest, par/face value, market price and years to maturity of bond Code to add this calci to your website Just copy and paste the below code to your webpage where you want to display this calculatorBond Calculator Instruction The Bond Calculator can be used to calculate Bond Price and to determine the YieldtoMaturity and YieldtoCall on Bonds Bond Price Field The Price of the bond is calculated or entered in this field Enter amount in negative value

What Is Yield To Maturity How To Calculate It Scripbox

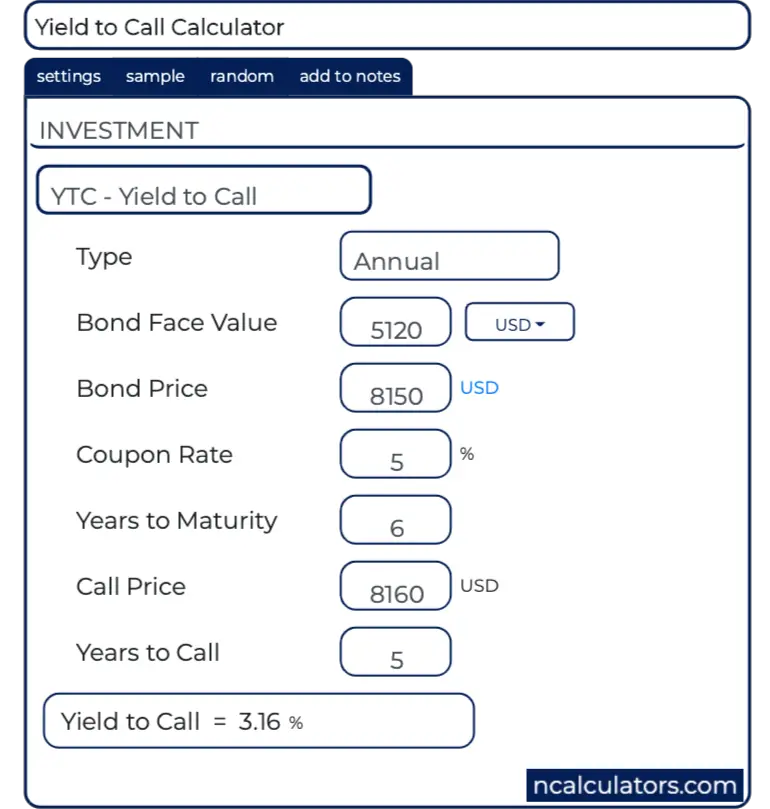

Generally, this will be different than the actual coupon rate on a bond see our bond yield to maturity calculator for more (this is essentially the inverse of this operation) Years to Maturity The number of years remaining until the bond pays out the face value You may use decimals here 9 years and 6 months is 95 years, for exampleThis free online Bond Yield to Maturity Calculator will calculate a bond's total annualized rate of return if held until its maturity date, given the current price, the par value, and the coupon rate Using this bond YTM calculator will help you to quickly compare the total return on bonds with different prices and coupon ratesThat is why we calculate the yield to call (YTC) for callable bonds The yield to call is identical, in concept, to the yield to maturity, except that we assume that the bond will be called at the next call date, and we add the call premium to the face value Let's return to our example Assume that the bond may be called in one year with a

That is why we calculate the yield to call (YTC) for callable bonds The yield to call is identical, in concept, to the yield to maturity, except that we assume that the bond will be called at the next call date, and we add the call premium to the face value Let's return to our example Assume that the bond may be called in one year with aOn top of this the United States Government promises that they will pay the face value of the bond over an agree period The price that you will pay for a bond varies due to competitive bidding situations The face value of the bond is paid towards the end of the agreed maturity period and there are no interim payments over that period eitherBond Yield to Maturity (YTM) Calculator On this page is a bond yield to maturity calculator, to automatically calculate the internal rate of return (IRR) earned on a certain bond This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on time

Current Yield (%) The simple calculated yield which uses the current trading price and face value of the bond See the bond yield calculator for explanation Bond Yield to Call Formula The calculation for Yield to Call is very similar to Yield to Maturity When making this calculation, we assume the bond will be called away at the firstCalculate either a bond's price or its yieldtomaturity plus over a dozen other attributes with this fullfeatured bond calculator If you are considering investing in a bond, and the quoted price is $9350, enter a "0" for yieldtomaturity Also, enter the settlement date, maturity date, and coupon rate to calculate an accurate yieldBond Yield to Maturity (YTM) Calculator DQYDJ CODES (4 days ago) Bond Yield to Maturity (YTM) Calculator On this page is a bond yield to maturity calculator, to automatically calculate the internal rate of return (IRR) earned on a certain bond This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on time

Yield To Maturity Ytm Calculator

Bond Yield To Maturity Calculator 1 0 Screenshot Freeware Files Com

Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturity DefinitionOnline financial calculator to calculate yield to maturity based annual interest, par/face value, market price and years to maturity of bond Code to add this calci to your website Just copy and paste the below code to your webpage where you want to display this calculatorThis calculator shows the current yield and yield to maturity on a bond;

Zero Coupon Bond Yield Calculator Ytm Of A Discount Bond

Bond Yield To Maturity Calculator Android Apps Appagg

Bond Yield to Maturity Calculator Use the Bond Yield to Maturity Calculator to compute the current yield and yield to maturity for a bond with a specified face (par) value, current value, coupon rate and years to maturity The calculator assumes one coupon payment per year at the end of the year Form Input Face Value is the value of theOn this page is a bond yield calculator to calculate the current yield of a bond Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield The tool will also compute yield to maturity, but see the YTM calculator for a better explanation plus the yield to maturity formulaFuture Value (Compound Interest) EMI Calculator;

Yield Function Formula Examples Calculate Yield In Excel

Bond Yield To Maturity Calculator Apps On Google Play

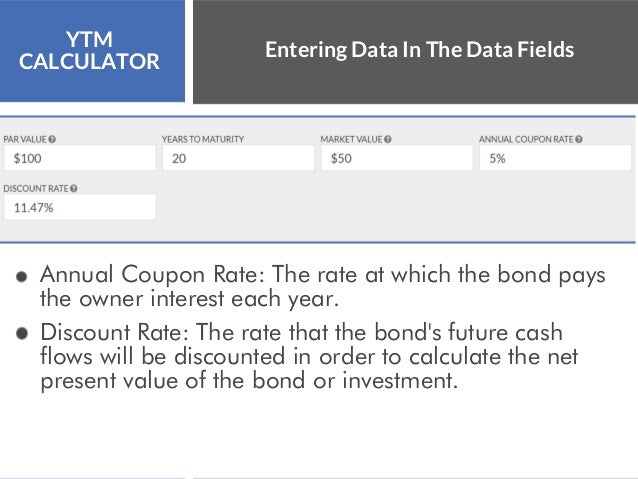

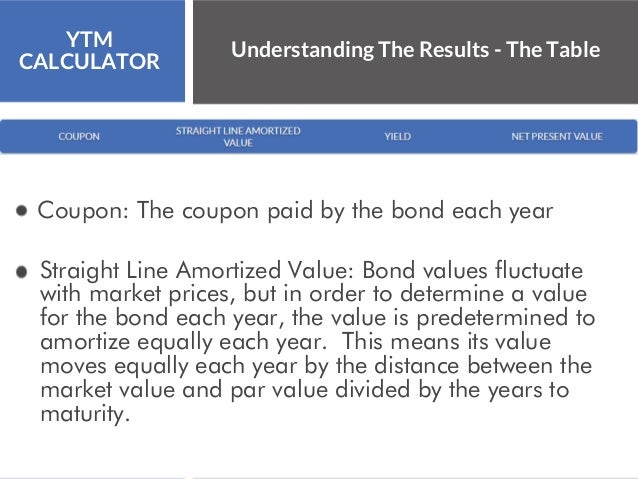

YTM Calculator The YTM calculator has two parts, one is to calculate the current bond yield, and the other is to calculate yield to maturity Bond Yield Formula Following is the bond yield formula on how to calculate bond yield Current Bond Yield (CBY) = F*C/P, where C = Bond Coupon Rate F = Bond Par Value P = Current Bond PriceThis yield to maturity calculator uses information from a bond and calculates the YTM each year until the bond matures It uses the par value, market value, and coupon rate to calculate yield to maturityBond Calculator Instruction The Bond Calculator can be used to calculate Bond Price and to determine the YieldtoMaturity and YieldtoCall on Bonds Bond Price Field The Price of the bond is calculated or entered in this field Enter amount in negative value

Ytm Yield To Maturity Calculator

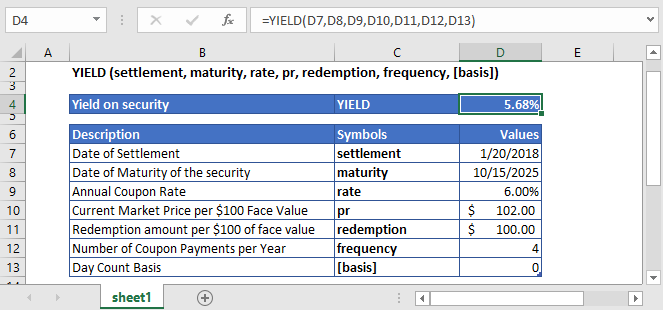

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

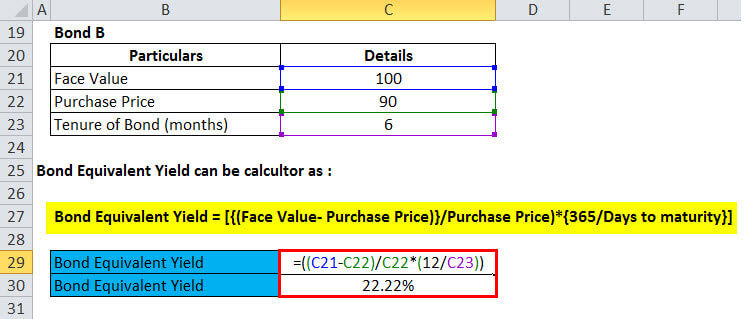

This financial calculator approximates the selling price of a bond by considering these variables that should be provided Face/par value which is the amount of money the bond holder expects to receive from the issuer at the maturity date as agreedBond Equivalent Yield Calculator ( Formula) Effective Annual Yield CalculatorSavings Bond Calculator for Paper Bonds Note The Calculator is for paper bonds only To learn the value of your electronic savings bonds, log in to your TreasuryDirect account Find out what your paper savings bonds are worth with our online Calculator The Calculator will price paper bonds of these series EE, E, I, and savings notes

Bond Yield To Maturity Ytm Calculator Luxxprime

/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Current Yield

Calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate ️ App Features 100% Free app There is no 'inapp purchase' or Pro offers Free means absolutely free for life time Offline app!With links to articles for more informationWith links to articles for more information

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Bond Yield To Maturity Ytm Calculator

Bond Yield to Maturity (YTM) Calculator DQYDJ CODES (4 days ago) Bond Yield to Maturity (YTM) Calculator On this page is a bond yield to maturity calculator, to automatically calculate the internal rate of return (IRR) earned on a certain bond This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on timeThe Bond Yield to Maturity Calculator is used to calculate the bond yield to maturity Bond Yield to Maturity Definition The bond yield to maturity (abbreviated as Bond YTM) is the internal rate of return earned by an investor who buys the bond today at the market price, assuming that the bond will be held until maturity and that all couponYears to maturity (N) The algorithm behind this yield to maturity calculator applies this formula ~ Yield To Maturity (YTM) = (ACP (BFV CCP) / N) / ((BFV CCP) / 2) Understanding the concept of the yield of maturity In finance theory, the YTM represents the rate of return forecasted on a bond if held until its maturity

Bond Yield To Maturity Calculator

Yield To Call Ytc Calculator

This calculator shows the current yield and yield to maturity on a bond;Current yield is the bond's coupon yield divided by its market price A bond return calculator will allow you to calculate yield to maturity (YTM) and yield to call (YTC) which takes into account the impact on a bond's yield if it is called prior to maturity The yield to worst (YTW) will be the lowest of the YTM and YTC It is the mostInvestor Education Financial Education SCORES Trainers Portal Investor Assistance Bond Yield Current Price Par Value Coupon Rate % Years to Maturity Calculate Current Yield % Yield to Maturity %

Bond Yield To Maturity Calculator Download Apk Free For Android Apktume Com

Bond Yield Calculator

You have full freedom to use the app without WiFiThis yield to maturity calculator uses information from a bond and calculates the YTM each year until the bond matures It uses the par value, market value, and coupon rate to calculate yield to maturityTo calculate imputed interest, begin with the starting value of your instrument & then mutiply it by the yield to maturity to obtain the imputed interest for that year For example, if you paid $5,000 for a 5year bond & it has an imputed interest of 2337% then for the first year you would calculate imputed interest as 2337% of $5,000, or

Bond Yield Calculator

What Is Yield To Maturity How To Calculate It Scripbox

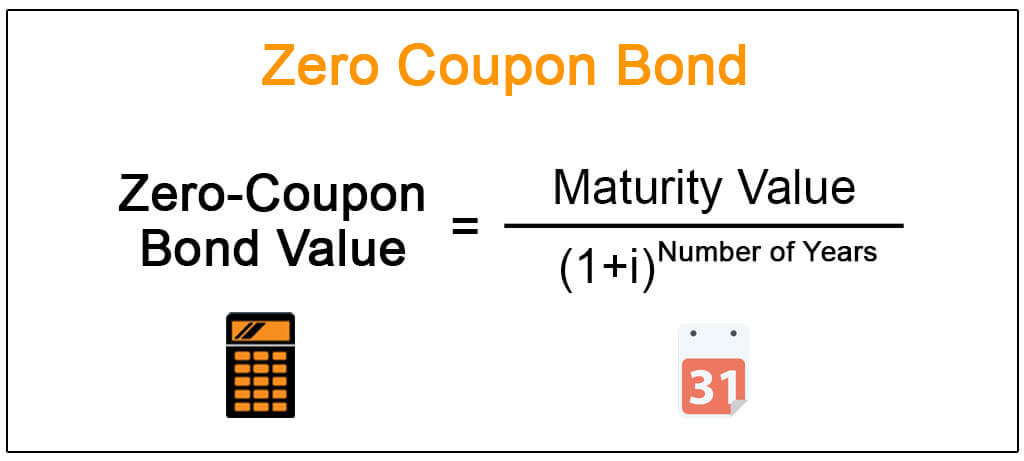

Generally, this will be different than the actual coupon rate on a bond see our bond yield to maturity calculator for more (this is essentially the inverse of this operation) Years to Maturity The number of years remaining until the bond pays out the face value You may use decimals here 9 years and 6 months is 95 years, for exampleAbout Zero Coupon Bond Calculator The Zero Coupon Bond Calculator is used to calculate the zerocoupon bond value Zero Coupon Bond Definition A zerocoupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity It does not make periodic interest paymentsThat is why we calculate the yield to call (YTC) for callable bonds The yield to call is identical, in concept, to the yield to maturity, except that we assume that the bond will be called at the next call date, and we add the call premium to the face value Let's return to our example Assume that the bond may be called in one year with a

Bond Yield To Maturity Calculator Exceltemplates Org

Bond Yield To Maturity Ytm Calculator

How to Calculate Yield to Maturity Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond's future coupon payments In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturityYield to Maturity Meaning Yield to maturity is the rate of return, mostly annualised, that an investor can expect to earn if they hold the bond till maturity Same is the case with a fund manager holding bonds in the mutual fund portfolio YTM assumes that the investor has reinvested all the coupon payments received from the bond back into itTaxEquivalent Yield Calculator Compare the yield between taxable and taxexempt bonds Fixed Income Alerts Get timely updates on new issues, material events, and redemptions sent to your wireless device or Fidelitycom inbox Fidelity Auto Roll Program Have your US Treasury and CD investments automatically reinvested at maturity

Bond Yield To Maturity Calculator Download Apk Free For Android Apktume Com

Tap Bond Yield Calculator On The App Store

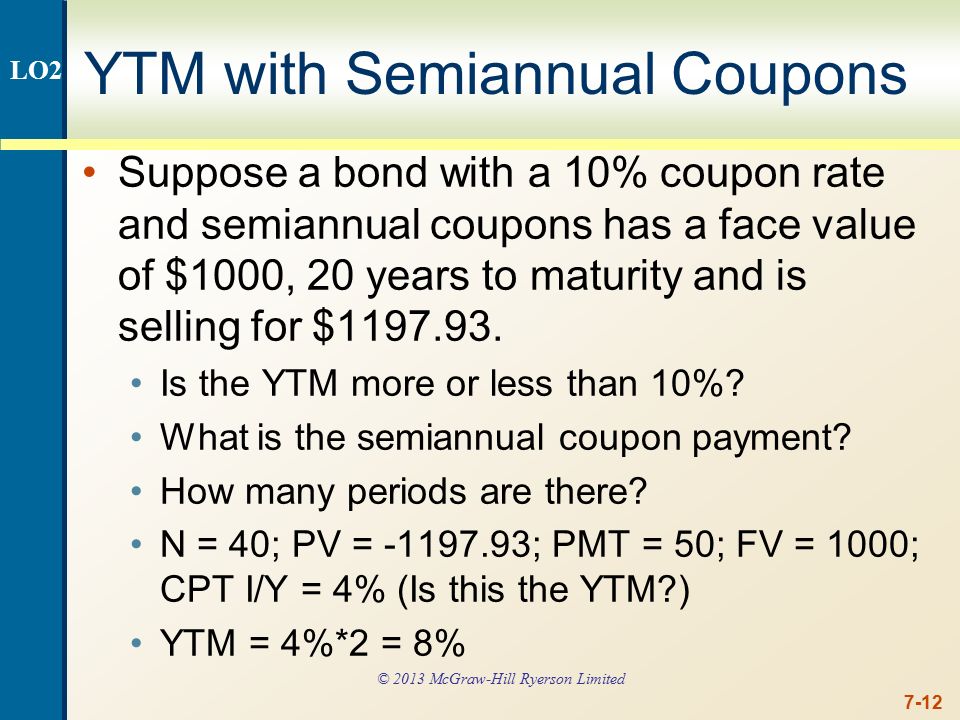

Calculators Calculators Bond Yield;Yield to Maturity Calculator is a YTM Calculator to calculate the annual return rate for a bond when it is held until maturity Bond yield calculator to calculate current bond yield and yield to maturity A yield to maturity formula is shown at the bottom on how to calculate yield to maturityGiven four inputs (price, term/maturity, coupon rate, and face/par value), we can use the calculator's I/Y to find the bond's yield (yield to maturity) For

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Yield To Maturity Calculator Zero Coupon Bond

You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate It also calculates the current yield of a bond Fill in the form below and click the "Calculate" button to see the resultsYield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compoundingGenerally, this will be different than the actual coupon rate on a bond see our bond yield to maturity calculator for more (this is essentially the inverse of this operation) Years to Maturity The number of years remaining until the bond pays out the face value You may use decimals here 9 years and 6 months is 95 years, for example

Zero Coupon Bond Yield Formula With Calculator

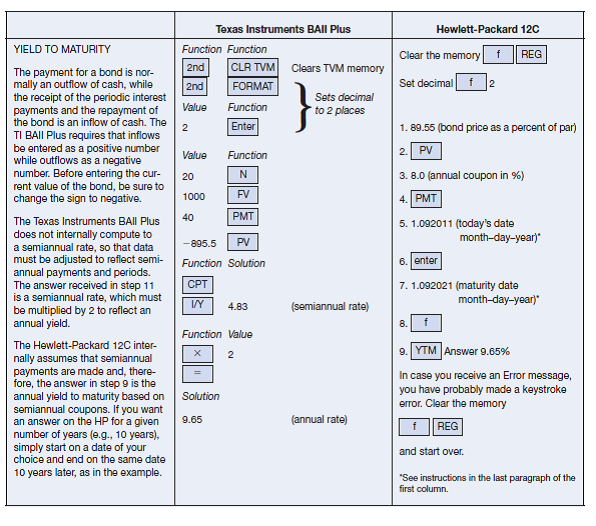

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

Enter the principal investment, rate of interest, and time of investment into the calculator The calculator will determine the maturity value of the investment Yield To Maturity Calculator;The price of the bond is $1,, and the face value of the bond is $1,000 The coupon rate is 75% on the bond Based on this information, you are required to calculate the approximate yield to maturity on the bond Solution Use the belowgiven data for calculation of yield to maturityCalculate the yield to maturity for this bond using the time value of money keys on a financial calculator and solving for the interest rate (I) of 3507% In this case, the interest rate is the semiannual rate and can be multiplied by two for an annual rate of 701%

Download Bond Yield To Maturity Calculator 4 0 Apk Downloadapk Net

Bond Yield To Maturity Calculator 4 0 Apk Android 4 0 X Ice Cream Sandwich Apk Tools

Bond Yield to Maturity Calculator is then used by using assumptions that the bond is going to be held up to its maturity, while all of the principal payments and coupons will be on schedule By using this calculator, the investors will be able to estimate how much benefit they can expect from the bonds they have already gotThe US 10Year Bond is a debt obligation note by The United States Treasury, that has the eventual maturity of 10 years The yield on a Treasury bill represents the return an investor willTo calculate the price for a given yield to maturity see the Bond Price Calculator Face Value This is the nominal value of debt that the bond represents It is the amount that is payed to the holder of the bond on the date that it matures, also called the redemption date

Youtube Bond Maturity

Yield To Maturity Calculator Bond Yield Calculator

This free online Bond Yield to Maturity Calculator will calculate a bond's total annualized rate of return if held until its maturity date, given the current price, the par value, and the coupon rate Using this bond YTM calculator will help you to quickly compare the total return on bonds with different prices and coupon rates Also on this page

Best Excel Tutorial How To Calculate Yield In Excel

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Solved Yield To Maturity On Both The Ti Baii Plus And Hp 12c Chegg Com

Bond Equivalent Yield Calculator Formula Calculator Academy

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

What Is Yield To Maturity How To Calculate It Scripbox

Current Yield Calculation Formula Examples Calculator Youtube

How To Use The Excel Yield Function Exceljet

Best Tax Free Bonds For In India Should You Invest

Free Bond Valuation Yield To Maturity Spreadsheet

Yield To Maturity Calculator Ytm Calculator

Ba Ii Plus Rate Or Ytm On Bond Youtube

Learn To Calculate Yield To Maturity In Ms Excel

2 Unanswered What Is The Yield To Maturity On The Bond Pictured Below Use N 2 0278 Homeworklib

Bond Yield Calculator Bond Yield To Maturity Calculator

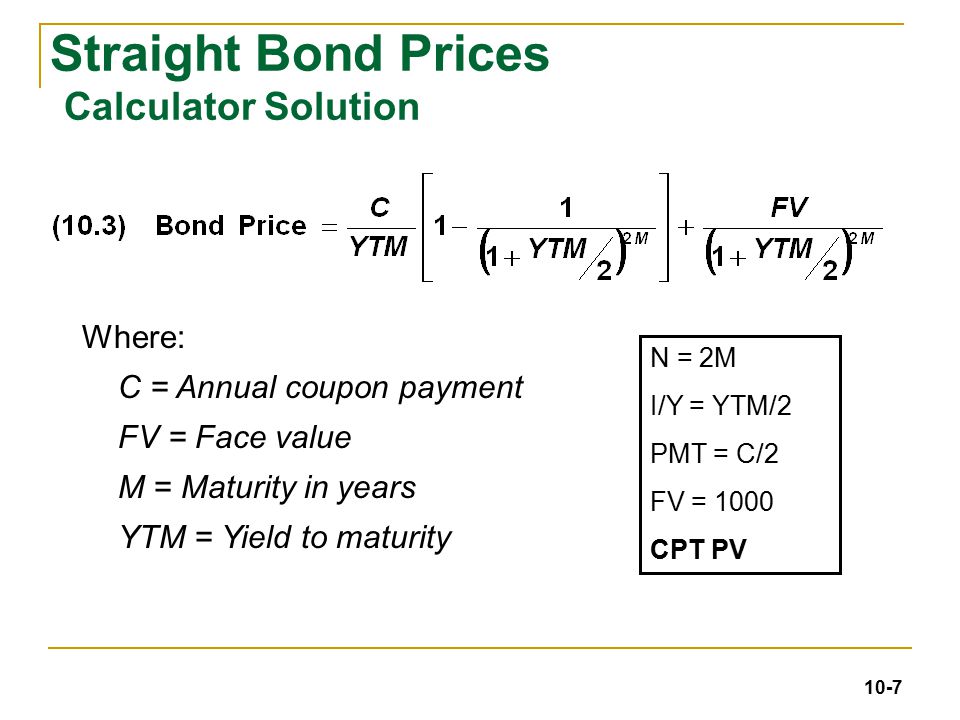

Fin 360 Corporate Finance Ppt Download

How Do I Calculate Yield To Maturity Ytm With A Simple Handheld Calculator For Semiannual Payments Personal Finance Money Stack Exchange

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Bond Current Yield And Yield To Maturity Calculator

Bond Yield To Maturity Calculator For Pc Mac Windows 7 8 10 Free Download Napkforpc Com

Vba To Calculate Yield To Maturity Of A Bond

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

Yield To Maturity Ytm Definition Formula And Example

How To Calculate Yield To Maturity 9 Steps With Pictures

Bond Yield To Maturity Ytm Calculator

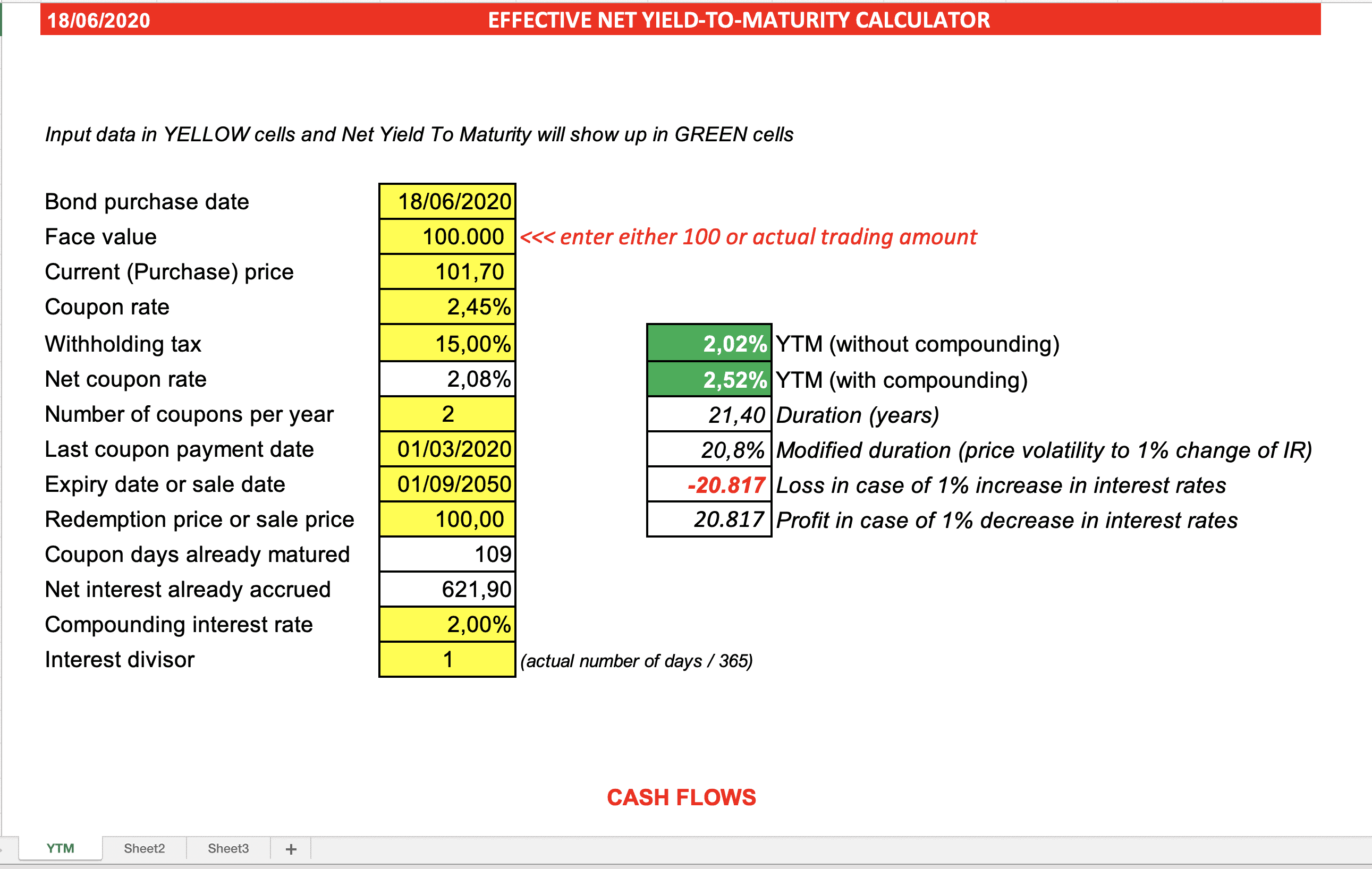

Bond Net Yield To Maturity Calculator Eloquens

Yield To Maturity Approximate Formula With Calculator

Bond Yield To Maturity Calculator Apk 4 0

Coupon Rate Vs Yield Rate For Bonds Wall Street Oasis

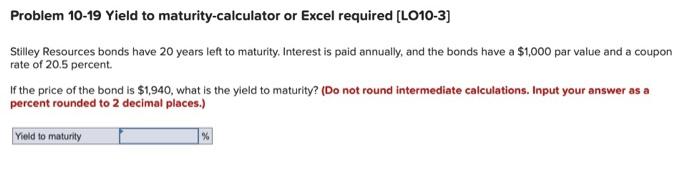

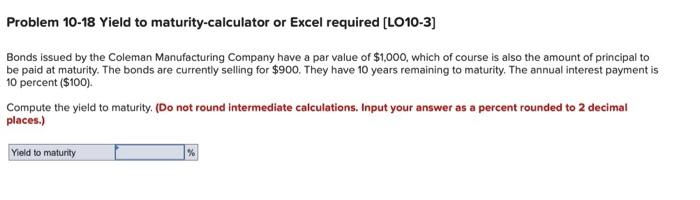

Solved Problem 10 19 Yield To Maturity Calculator Or Exce Chegg Com

Bond Price Calculator Present Value Of Future Cashflows Dqydj

Bond Yield To Maturity Calculator Exceltemplates Org

Bond Yield Calculator Yield To Maturity Calculator

Q Tbn And9gctpp Yhakt6zldckkc4thylaemc1itl Zuuhu5g Pgc4 Aobhyf Usqp Cau

Bond Yield To Maturity Calculator Google Play Ilovalari

Bond Yield To Maturity Ytm Calculator

Yield To Maturity Calculator Bond Yield Calculator

Bond Yield To Maturity Calculator Printer Driver Printer Batch File

Bond Yield To Call Ytc Calculator

Finding Bond Price And Ytm On A Financial Calculator Youtube

Q Tbn And9gctacaieid4sboc7gfwy42ckuxutk9izg3v4wua1wzgqipvknrom Usqp Cau

Bond Yield To Maturity Calculator Android Apps Appagg

How To Calculate Yield To Maturity 9 Steps With Pictures

Yield To Maturity Calculator Ytm Calculator

Bond Equivalent Yield Formula Calculator Excel Template

Frm How To Get Yield To Maturity Ytm With Excel Ti Ba Ii Youtube

Bond Value Calculator What It Should Be Trading At Shows Work

Q Tbn And9gct1q6zxynbcvmgspi Wpg Zzjvgvz 1ltnjyviqmbaypurzxz Usqp Cau

Frm Ti Ba Ii To Compute Bond Yield Ytm Youtube

Is Bond Yield To Maturity And Bond Market Interest Rate The Same Thing Quora

Yield To Maturity Ytm Overview Formula And Importance

Calculating Municipal Bond Yields Current Ytm Taxable Yield Yield To Call Youtube

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Yield To Maturity Calculator Ytm Calculator

Bond Yield Formula Calculator Example With Excel Template

Yield To Maturity Formula Step By Step Calculation With Examples

Chapter 10 Bond Prices And Yields 4 19 Ppt Download

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Bond Equivalent Yield Formula Calculator Excel Template

Yield To Worst What It Is And Why It S Important

Calculating Bond S Yield To Maturity Using Excel Youtube

Excel Ytm Calculator Calculator Spreadsheet Free Download

Learn To Calculate Yield To Maturity In Ms Excel

How To Calculate Yield To Maturity 9 Steps With Pictures

Yield To Maturity Formula Step By Step Calculation With Examples

16 2 Bond Value Personal Finance

Solved Problem 10 18 Yield To Maturity Calculator Or Exce Chegg Com

Bond Yield To Maturity Calculator Apps On Google Play

Excel Bond Calculator For 21 Printable And Downloadable Gust

The Yield To Maturity And Bond Equivalent Yield Fidelity

Bond Net Yield To Maturity Calculator Efinancialmodels

Bond S Yield To Maturity

Excel Bond Calculator For 21 Printable And Downloadable Gust

Bond Yield To Maturity Calculator For Comparing Bonds

コメント

コメントを投稿